The value of the UK video game consumer market in 2022 was £7.05 billion. This figure represents a stabilisation following several years of unprecedented growth. Although this is a 5.6% dip on 2021’s figure, it’s still 17% above pre pandemic levels.

How much money was spent on game software in the UK in 2022?

Software revenues remained steady, growing 0.4% to £4.57 billion, thanks in part to growth in digital PC and mobile games sales. Mobile software was up 11% year-on-year to £1.43 billion.

Digital console revenues were down by 4.7%, while boxed game sales declined 4.3%, making 2022 the only year in the past decade where boxed software has seen better year-on-year performance than digital console sales. This suggests a levelling off of the decline in boxed software sales over the past decade as digital formats have grown in popularity. The pre-owned market was also down to £21 million.

How much money was spent on games developed by British companies in the UK in 2022?

For the first time we've investigated the UK market share of UK-made games based on research from Ukie and data provided by GfK Entertainment. In 2022, 16% of the £4.57bn game software total was spent on games developed by British game companies.

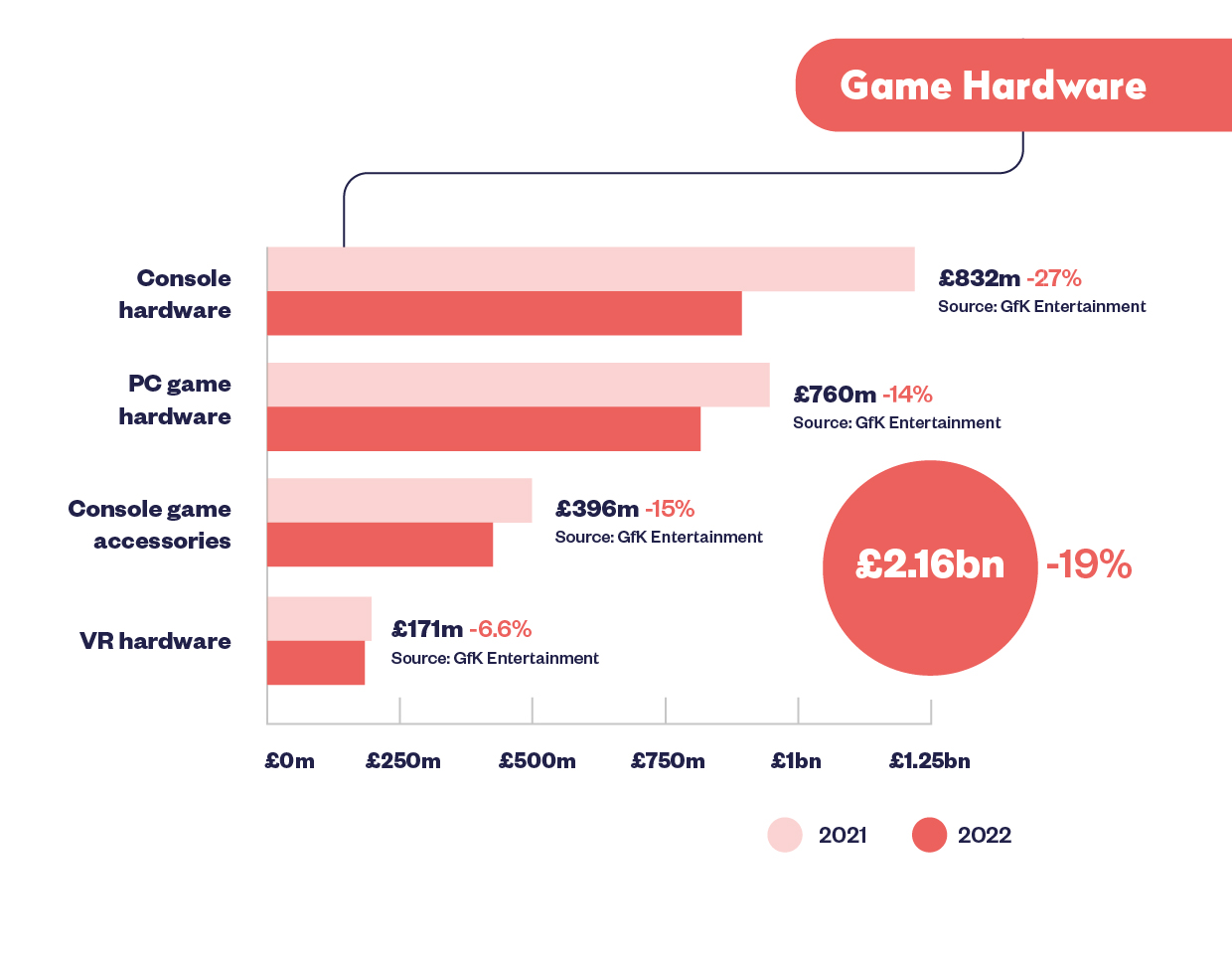

How much money was spent on game hardware in the UK in 2022?

Compared to 2021, sales of all forms of video game hardware in 2022 were down 19% to £832 million, with console revenue down 27%, PC game hardware 14% and VR hardware by 6.6% year-on-year.

This aligns with historical hardware sales figures, where similar declines were seen two to three years after new generation console hardware hit the market.

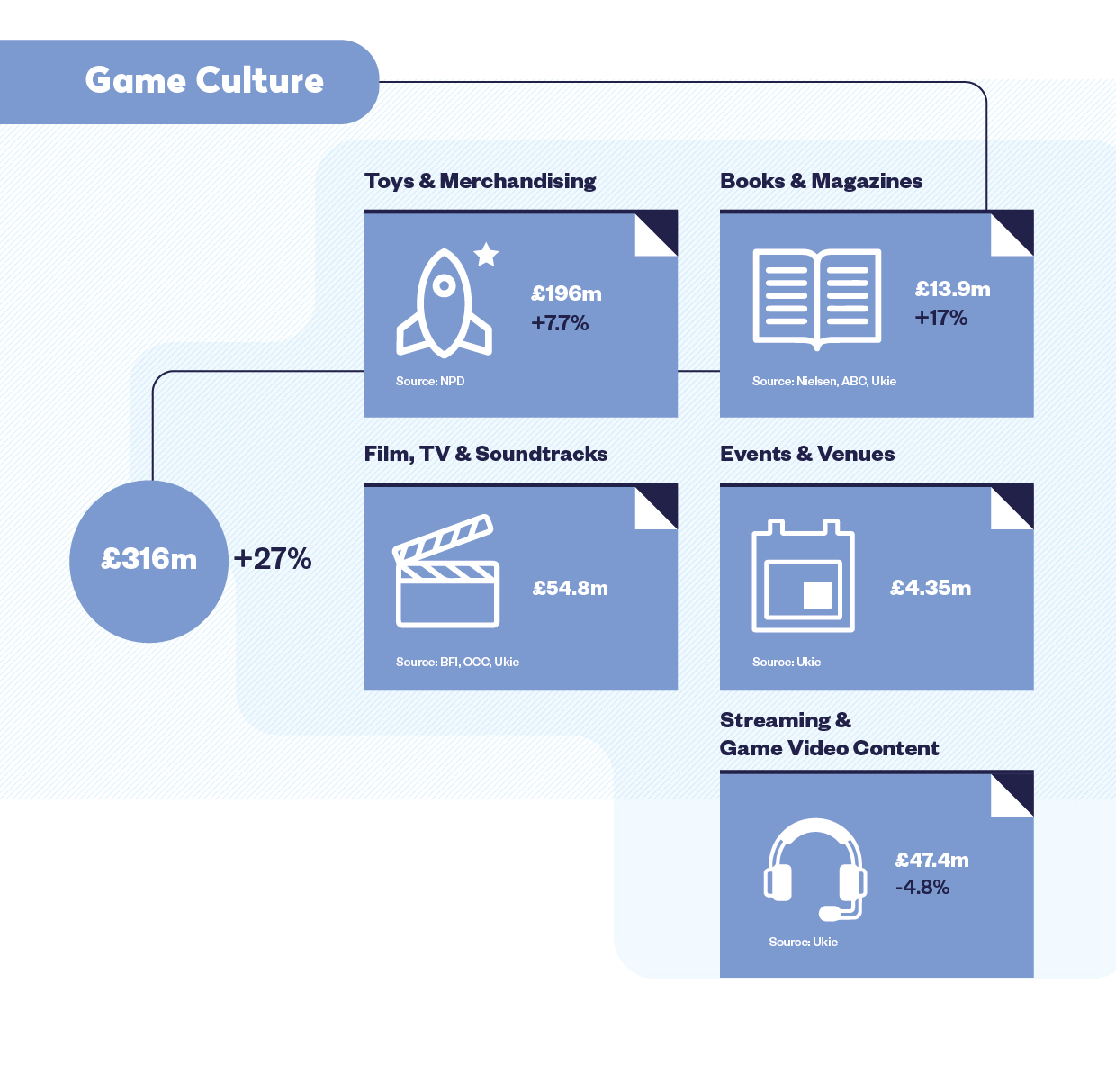

How much money was spent on game culture in the UK in 2022?

Streaming and game video content fell by 4.8% in 2022, which is an anticipated decline following the pandemic boom period as overall industry figures level out post-pandemic.

Big screen video game adaptations Uncharted and Sonic The Hedgehog 2 contributed to a significant year-on-year increase for television and soundtracks to £54.8 million. This was the biggest year for films based on video games IP at the UK box office ever, up 66% from 2019’s figure of £33 million, adjusted for inflation.

Data from video streaming platforms for video game-related programming like Paramount’s Halo series is not factored into the 2022 valuation, however this is being explored for next year’s report.

Toys and merchandising saw a 7.7% increase year-on-year, bucking the trend of a 3% fall in the wider toy market, with Pokémon merchandise being the top performer in a year with multiple high-profile new entries in the long-running franchise.

Book and magazine revenues were up 17% year-on-year to £13.9 million.

Event revenues recovered significantly in 2022, more than tripling the figure for 2021 when events were still being heavily impacted by the pandemic. This recovery was driven by a return of established UK events such as Insomnia, and boosted by one-off international events heading to the UK, like the Pokémon World Championships in London.

In 2022 event revenues hit £4.35 million, which is still 56% lower than the inflation-adjusted pre-pandemic figure of £9.93 million for 2019, so there is still room to grow as confidence returns both among attendees and exhibitors.

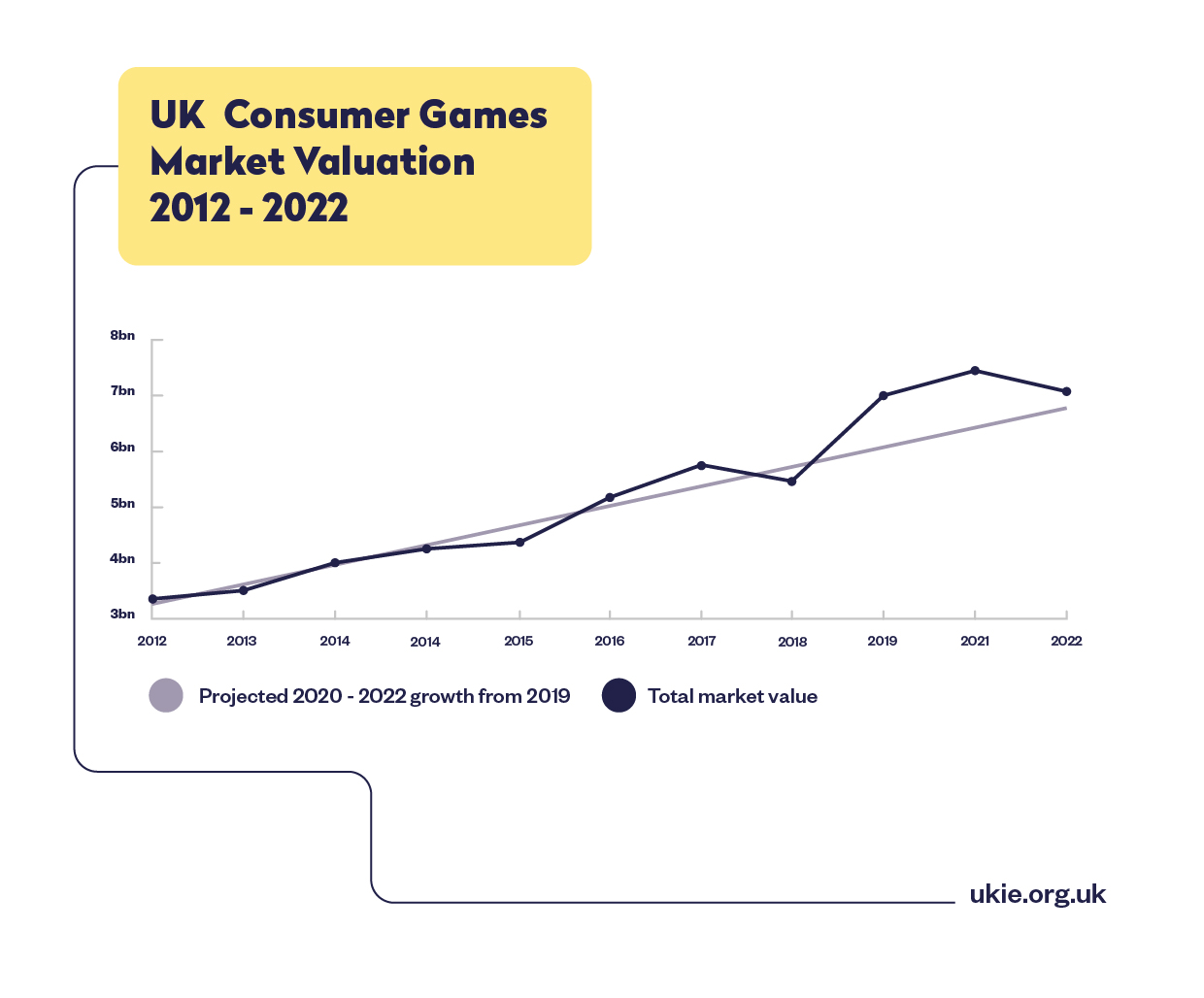

How much money was spent on games in the UK in 2022 compared to before the pandemic?

The overall value of the UK consumer market is up 17% compared to pre-pandemic figures. The UK video game market was valued at £5.3 billion in 2019, which is £6.03 billion when adjusted for inflation. Charted against consumer spending data over the past decade, the 2022 valuation aligns with pre-pandemic projections.

Software sales have seen solid growth compared to 2019, up 6.6% against 2019's inflation-adjusted figure, while hardware sales exceeded 2019's figures by 38%. This was expected, as 2019 marked the final full year of the previous generation of consoles, with the PlayStation 5 and Xbox Series X|S launching in 2020.

What did key data partners have to say?

“We’re pleased to see the UK video games consumer market has maintained its growth trajectory and remains in-line with where we expected it to be in 2019,” said Ukie CEO Dr. Jo Twist OBE. “Although we may have seen a natural levelling off following increased spending during the lockdown years, it’s clear that the appetite for games and games culture in the UK is still strong.”

The BFI’s Deputy Chief Executive/Executive Director of Corporate & Industry Affairs said: “Development spend on creating new video games fluctuates year-on-year influenced by when work starts on larger video games projects. However, the continued strength of the UK video games sector shows how it is contributing creatively to the creative industries as well as jobs and additional revenue to the UK economy.”

Dorian Bloch, Senior Client Director at GfK said: “Console Hardware remained the biggest sector in game hardware but saw the steepest decline in 2022 due in part to the natural progression and uptake of ninth generation consoles which is set against the decline of the previous generation.

“Other factors included well-documented supply chain component issues, higher cost of raw materials due to shortages and shipping slow-down at warehouses and ports, which affected all hardware sectors including video games.

“Much can still be attributed to Covid uncertainty, but the Russia-Ukraine war, recession, inflation, rising energy/food/living costs all play a part in dampening consumer confidence, with consumers putting off major purchase decisions – including of course game hardware.”

Matt Bailey, Principal Analyst with Omdia said: “The digital segment of the UK's console market was impacted by a further shift towards pre-pandemic engagement levels, resulting in fewer downloads of legacy software titles and reduced spend on console DLC.

A lack of hardware supply - particularly for PS5 - also prevented many would-be ninth-generation console owners from shifting their spend toward higher value digital content. And, although console subscription services remain a key area of growth, they are not yet generating the amount of spend required to offset declines in other areas of digital console spend.

“PC digital was relatively flat, propped by the microtransactions segment. The healthy debut of Valve’s Steam Deck – which we estimate sold 135k units in the UK in 2022 – indicates there’s still appetite for spend residing in the PC market.”