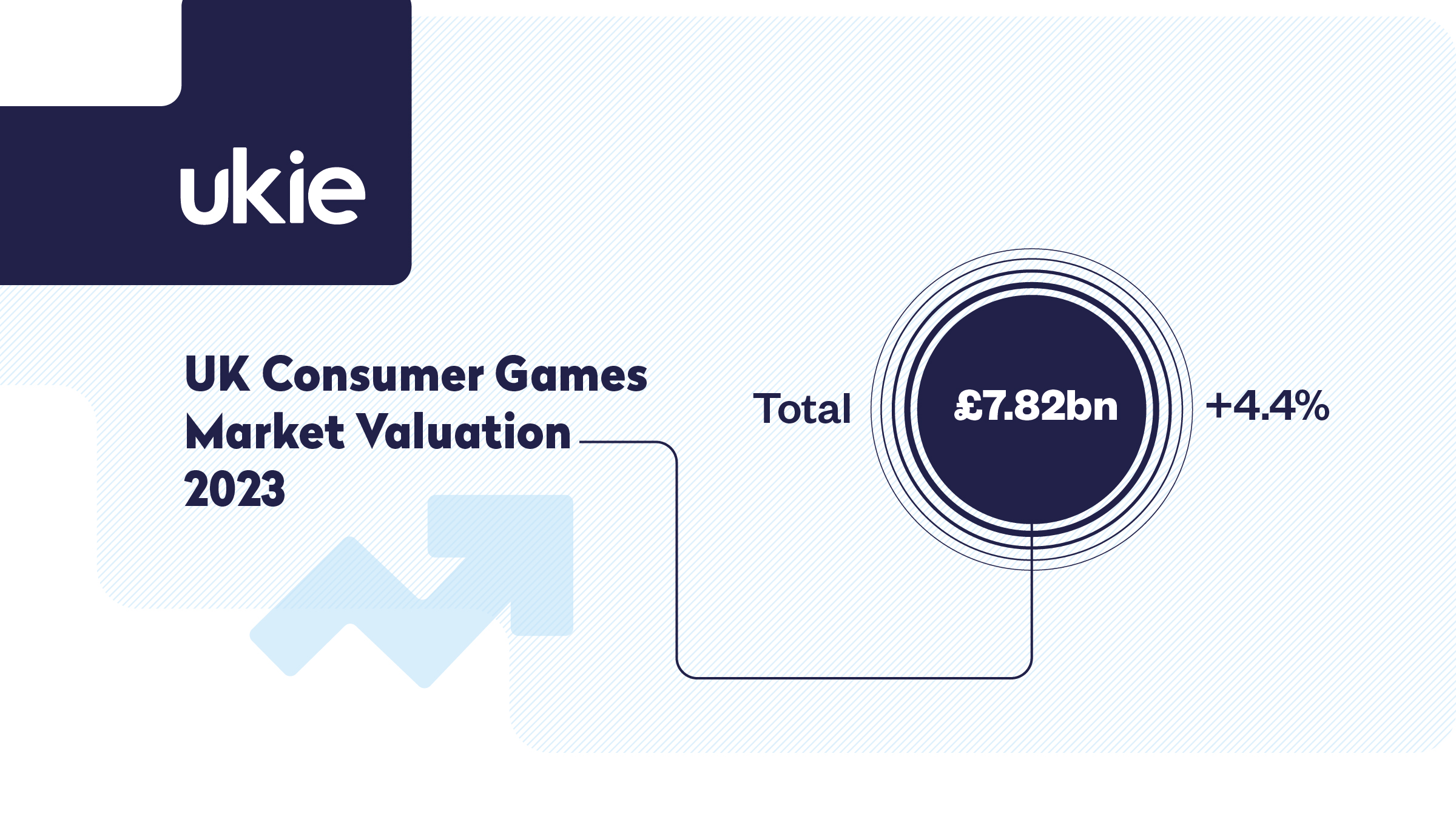

The UK video games market continues on a strong path of growth, reaching a value of £7.82 billion in 2023.

Ukie, the leading trade body representing the UK's video games and interactive entertainment sector, has today published the Ukie Consumer Market Valuation Report which shows that the UK video games consumer market is value in 2023 was £7.82 billion. This marks a 4.4% increase from the revised 2022 total of £7.49 billion. In face of strong headwinds, this increase underlines the video games market's stability and resilience, as well as consumers unrelenting appetite for games and games culture.

Nick Poole said:

“I am pleased to announce the release of Ukie's Consumer Market Valuation Report – the industry standard valuation for the video games and interactive entertainment industry. Once again, the Report showcases the vitality of interactive entertainment in the UK in the face of significant challenges.

The market valuation of £7.82bn in 2023, a 4.4% net increase on the previous year, underscores the enduring appeal and vitality of the UK’s interactive entertainment industry in today's global marketplace.

While celebrating this positive trajectory, we also acknowledge the current market correction affecting some of our member companies, resulting in unfortunate staff layoffs. As an industry, we remain committed to supporting our workforce and games businesses through these transitions, fostering a resilient ecosystem that prioritises innovation and sustainability.

The video game industry continues to evolve rapidly, presenting both challenges and opportunities. As we continue to see changing patterns of consumer behaviour in how people buy and play games, these figures give us real confidence that games will continue to pioneer tomorrow’s frontiers in entertainment, learning and participation.”

The Consumer Market Valuation report measures the wider cultural consumption of games in the UK beyond, but still including video game hardware and software sales.

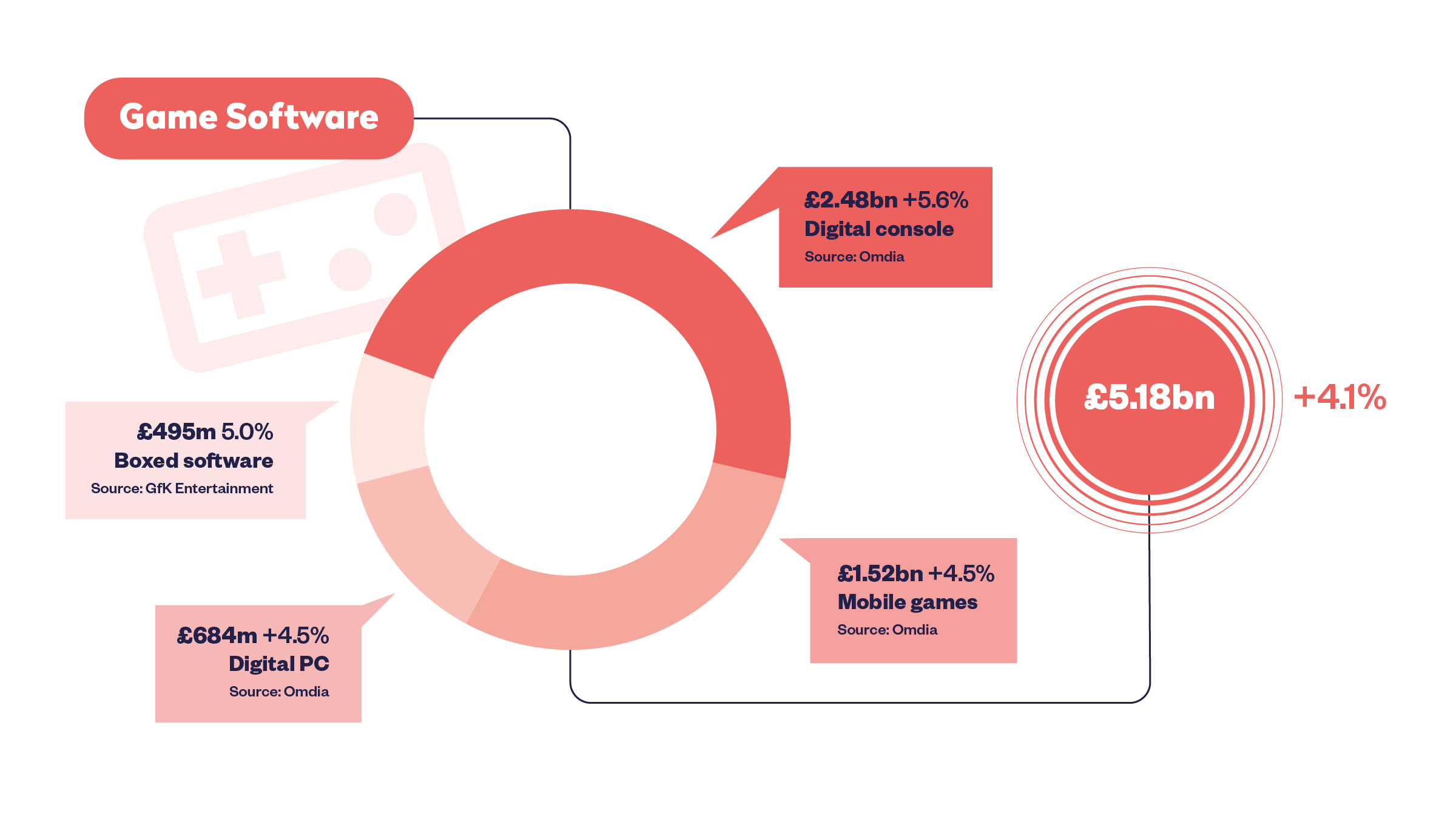

The latest figures show that game software sales increased to a total of £5.18 billion, a 4.1% increase from the previous year. However, boxed software sales witnessed a slight decline of 5.0%, amounting to £495 million. Conversely, digital console software sales rose by 5.6% to £2.48 billion, while digital PC software sales saw a modest increase of 4.5%, reaching £684 million. Mobile game sales also contributed to the growth, witnessing a 4.5% increase to £1.52 billion.

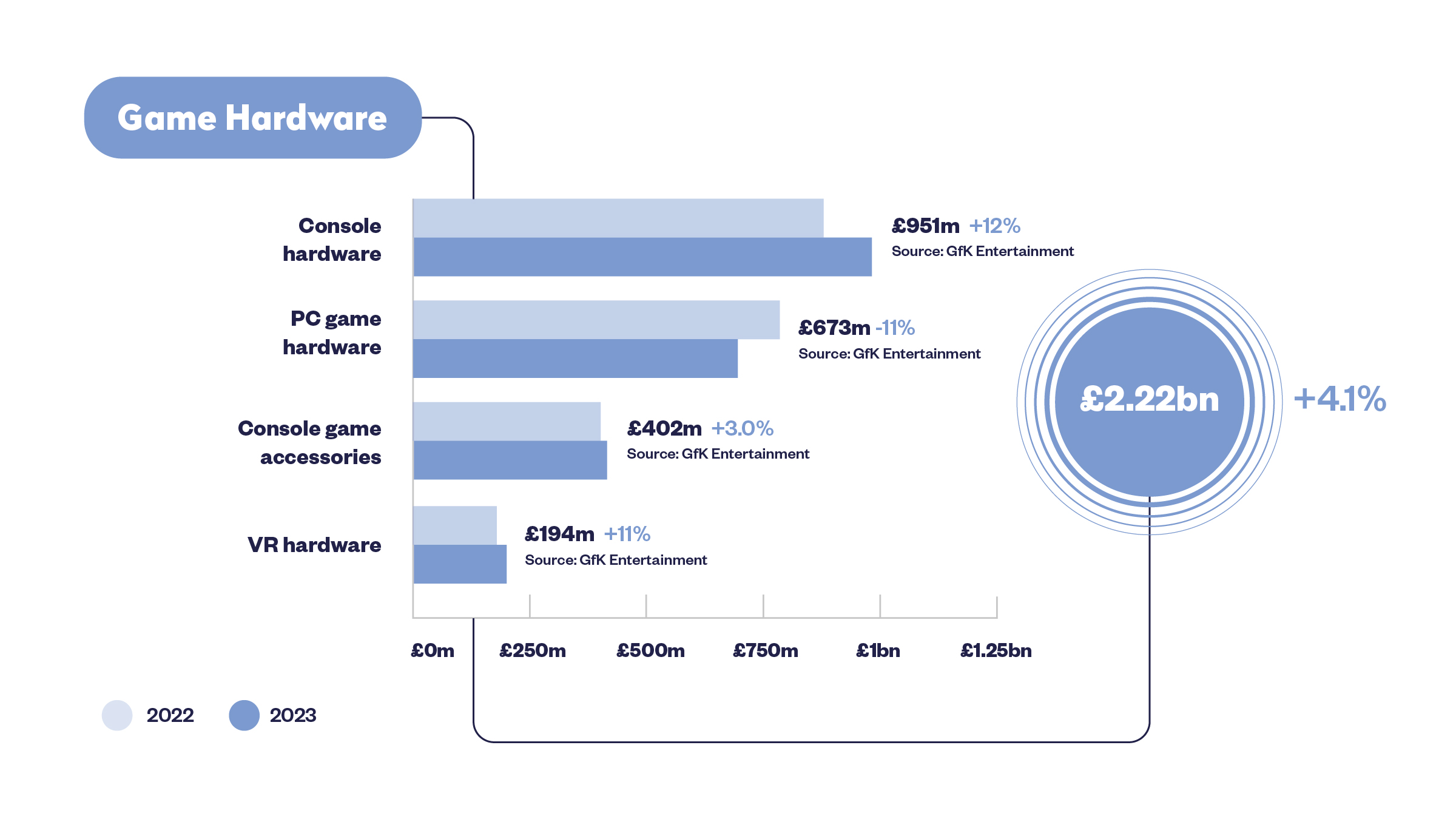

Turning to game hardware, the total sales reached £2.22 billion in 2023, showing a modest 2.1% increase from the previous year. Console hardware sales notably surged by 12% to £951 million, indicating continued strong demand for gaming consoles. However, PC game hardware sales experienced a decline of 11%, totalling £673 million. Console game accessories saw a modest increase of 3.0%, reaching £402 million, while VR hardware sales soared by an impressive 11% to £194 million.

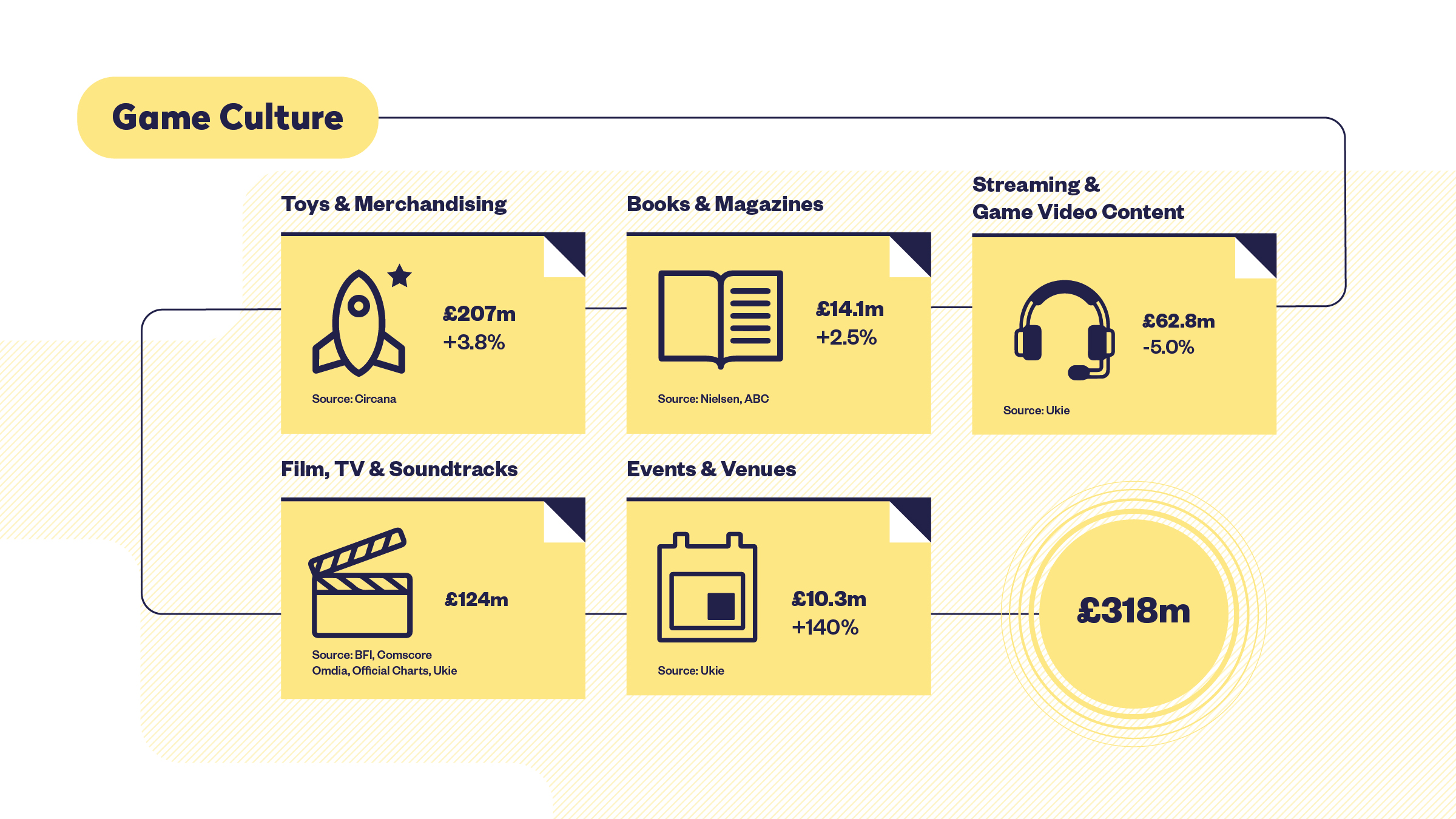

For the first time our data accounts for digital & TV based on video game properties, as a result, broader game culture sector, encompassing toys, merchandising, books, magazines, film, TV, soundtracks, events, and streaming content, saw a total revenue of £418 million. Toys and merchandising experienced a 3.8% increase, totalling £207 million, while book and magazine sales rose by 2.5% to £14.1 million.

Revenue from film, TV, and soundtracks reached £124 million, and events and venues revenue surged by 140% to £10.3 million, driven by notable events such as Pokémon GO Fest and Apex Legends Global Series. However, streaming and gaming video content revenue declined by 5.0%, totalling £62.8 million, reflecting a post-pandemic adjustment in consumer behaviour.

James McWhirter, Omdia Senior Analyst:

“Digital spend within the UK's console market returned to growth in 2023 as PlayStation 5 hardware sales volumes hit their stride, while Nintendo Switch remained remarkably resilient as a bumper lineup of first party software propped up active users and spend on the now seven-year-old platform.

This helped grow and maintain an audience for high value digital content across both established and emerging games. Indeed, the UK games market was graced with no shortage of top performing new content as titles such as Diablo IV, Hogwarts Legacy, Spider-Man 2, Super Mario Bros. Wonder, Tears of the Kingdom, EA Sports FC 24 and Baldur's Gate 3 saw their release, among others.

Meanwhile, declines in PlayStation 4 digital content spend were lower than anticipated, owing to the late arrival of Roblox to the platform in Q4, coupled with a prolonged cross-generation period which led to the release of major titles such as Hogwarts Legacy and Resident Evil 4 on the ten-year-old system.”

Dorian Block, GfK Entertainment:

“Box SW slight decline was better than expected thanks to some decent performances on certain new releases in 2023 and a market more focused on Gen9 software (PS5/Series). For Switch, there was also the Zelda effect in Q2/23, with Tears of the Kingdom spiking Switch sales and pushing the overall Switch ASP in Q2/23 up to a level not seen since Q2/20.

In 2023 software revenue for Sony formats (PS4/PS5) overtook Nintendo formats (Switch).Total sales achieved a higher overall ASP than any other year on record (£36 overall).This was achieved by the fact that there were 17 major titles in 2023 that remained above £50 over the entire year (accounting for 34% of 2023 revenue), compared to just 8 titles in 2022 (accounting for 21% of 2022 revenue).”